Procore <-> QuickBooks Online Setup Guide

Guide for the setup process of the Smoothx Procore & QuickBooks Online integration

Walkthrough Video of Integration:

https://support.smoothx.com/walkthrough-video-qbo

Login to Smoothx Connector:

Login URL: https://app.smoothx.net/

Email and Password will be sent through by Smoothx prior to the initial onboarding meeting. The integration uses a single user credential, this can be adjusted and shared as needed as discussed in the following section.

Change Password/Security Settings:

Once logged in, click your company initials at top right hand side and select Profile.

From here, you are able to change the login email if required, password and setup two factor authentication if required.

Connect Procore and QuickBooks accounts:

First step is to Connect Procore account to Smoothx. This will not turn the integration live, but will allow Smoothx to pull Procore projects, vendors, cost codes, employees, tax codes and so on into the integration to begin the initial mapping process.

To connect your Procore account to the integration, navigate to the Settings page, then go to Procore & QuickBooks Access, then click Connect to Procore

After the Procore account has been connected to the integration, the next step is to make sure that the correct Procore account has been selected in the dropdown list shown in the following screenshot (this dropdown selects from the Procore accounts the user has access to):

Next it is time to connect your QuickBooks account to Smoothx. This will not turn the integration on live, but rather allow Smoothx to retrieve QuickBooks projects, vendors and customers, chart of accounts, product and services, tax codes, locations and classes.

In order to connect your QuickBooks Online account to Smoothx’s Integration go to Settings -> Procore & QuickBooks Access, then click Connect to QuickBooks (note that you must be a QuickBooks Admin on this account to authorize the software connection)

:

Mapping:

Before the integration can be switched on fully, the initial mapping must be completed.

This involves mandatory mapping of your projects, customers/vendors, and cost codes. These will be required in order for the integration to be switched on, the other mapping sections in the integration will be mapped as necessary, (for example if you wish to select tax codes on line items in Procore you can map tax codes in the Smoothx mapping page).

Mapping Procore Companies with QuickBooks Customers and Vendors

Best practice for mapping your Procore account and QuickBooks account is to begin with mapping existing Procore Companies with QuickBooks customers and vendors. This will mean that all your companies in Procore will have a corresponding QuickBooks vendor/customer.

Once a vendor/customer is mapped it will move away from the 'Procore Contacts' tab or the 'QuickBooks Contacts' tab into the 'Mapped Contacts' tab. The entries in existing in either the 'Procore Contacts' tab or 'QuickBooks Contacts' tab are currently unmapped

There are a few options on how this mapping can occur based on your company's circumstances.

These circumstances are:

1. We are existing QuickBooks users and brand new to Procore

2. We are existing Procore users but brand new to QuickBooks

3. We are new to both Procore and QuickBooks

4. We are existing users of both Procore and QuickBooks

Circumstance 1: Existing QuickBooks users and brand new to Procore

If you are brand new to Procore but existing QuickBooks users then likely you will not have any existing companies in Procore and a large list of suppliers, subcontractors and customers in QuickBooks. There are three options in this circumstance.

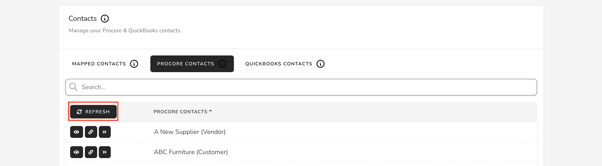

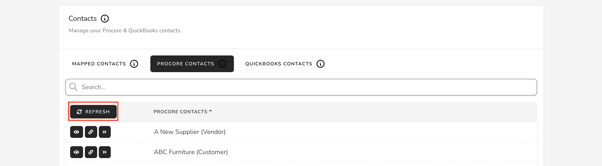

Option 1: A Smoothx employee can bulk push all QuickBooks customers/vendors into Procore. This option is good when you have recently audited your list of vendors and customers in QuickBooks and happy for every single one to be present in Procore. These can also be removed from Procore afterwards if you're certain they will not be needed again after the customer/vendor list from QuickBooks has been pushed to Procore.Option 2: Upload the companies you want to use in Procore directly into Procore, and then use the Smoothx automap function. This option will mean that you will only map vendors and customers that you want to exist in Procore (not every QuickBooks vendor/customer). To upload companies in Procore reference this article. Once companies are loaded in Procore, within Smoothx in the 'mapping' page, scroll down to “contacts”. From here click on the "Procore Contacts" tab and click refresh.

Click on the QuickBooks contacts tab and also click sync. Finally click on the mapped contacts tab and select automap. This will automatically map the Procore companies you have just loaded with the QuickBooks customers/vendors.

'Automap' will check to see names that look to be the same in both systems and map them automatically. There is some leniency however (such as ignoring 'LLC') so make sure to double check the list after it maps these for you.

Option 3: Via the Smoothx interface you are able to push individual QuickBooks vendors or customers into the Procore directory as new companies. This will also map it within the Smoothx Contacts section.

This option is good if there is a small number of vendors/customers that exist in QuickBooks that you want to push to Procore. To do this click on QuickBooks contacts and select sync to bring your existing customers/vendors from QuickBooks into the section.

Next to each customer/vendor there will be an icon that looks like ">>". If you click this next to a vendor/customer, the integration will create the vendor/customer in Procore with the information from QuickBooks and map it for you.

Circumstance 2: Existing Procore users and new to QuickBooks

If you are brand new to QuickBooks but existing Procore users then likely you will not have any existing vendors/customers in QuickBooks and a large list of suppliers, subcontractors and customers in Procore. There are three options in this circumstance.

Option 1: A Smoothx employee can sync all Procore companies to QuickBooks as vendors. The ones that are customers can be adjusted on the QuickBooks end and then mapped in the contacts section.

Option 2: Upload/create the vendors and customers you want directly into QuickBooks, and then use the Smoothx automap function. Once vendors/customers are loaded in QuickBooks, within Smoothx under mapping, scroll down to “contacts”. From here click on the Procore contacts tab and click refresh.

Click on the QuickBooks contacts tab and also click sync. Finally click on the mapped contacts tab and select 'Automap'. This will automatically map the QuickBooks customers and vendors you have just loaded into QuickBooks with your existing Procore company directory.

'Automap' will check to see names that look to be the same in both systems and map them automatically. There is some leniency however (such as ignoring 'LLC') so make sure to double check the list after it maps these for you.

Option 3: Via the Smoothx interface you are able to push individual Procore companies into QuickBooks Online. This option is good if there is a small number of vendors/customers that exist in Procore that you want to push to QuickBooks. To do this click on Procore contacts and select sync. Next to each customer/vendor there will be a ">>" icon. If you click this next to the Procore company, Smoothx will send this through to QuickBooks and map it for you.

Circumstance 3: Brand new Procore users and brand new to QuickBooks

If you are brand new to QuickBooks and Procore then likely you will not have any existing vendors/customers in either system. Typically there is two approaches:

Option 1: Upload vendors/customers in either Procore or QuickBooks, and then request a Smoothx employee to push all vendors/customer to the other systemOption 2: Upload vendors/customer in both systems, then sync them into the Smoothx 'Contacts' section by going to the 'Procore Contacts' tab and clicking 'sync' then going to the 'QuickBooks Contacts' tab and clicking 'sync'.

After doing this, go to the 'Mapped Contacts' tab and select 'automap'.

'Automap' will check to see names that look to be the same in both systems and map them automatically. There is some leniency however (such as ignoring 'LLC') so make sure to double check the list after it maps these for you.

Circumstance 4: Existing Procore and QuickBooks User

In the case that you are an existing user of both systems, what you will need to do is use the mapping tool to associate your existing Procore directory to your customer/vendor list in QuickBooks. To do this, firstly, sync in the Procore companies in the 'Procore Companies' tab. Then sync the QuickBooks companies in from the 'QuickBooks Companies' tab. Then, you can go to the 'mapped contacts' tab and press the 'automap' button.

'Automap' will check to see names that look to be the same in both systems and map them automatically. There is some leniency however (such as ignoring 'LLC') so make sure to double check the list after it maps these for you.

After this, there will likely be some leftover entries in both the 'Procore Companies' tab and the 'QuickBooks Companies' tab. These can then be linked individually in either the 'Procore Companies' tab or the 'QuickBooks Companies' tab by clicking the chain button and selecting the corresponding company in the other system using the dropdown menu.

Mapping Procore Projects with QuickBooks Sub customers/Projects - Setup

Once the customers/vendors have been mapped into both systems, the next step is to map Procore Projects with QuickBooks. When the integration is live, how it will work is any new Procore Project created will create a subcustomer in QuickBooks with the Project's name from Procore.

Due to the way the system works, it will create a 'subcustomer' in QuickBooks rather than a 'project'. To convert it into a QuickBooks project follow this guide:

https://support.Smoothx.net/subcustomer-conversion-into-projects-guide

In order for Smoothx to create a sub customer in QuickBooks when a new Procore project is created, you must select the 'Customer' in QuickBooks it will be sent to when it syncs. To do this, there will need to be a field set up for the project's admin tool in order to select the customer for each Procore project.

Create Custom field for Customer in Procore:

Creating the “customer” custom field in Procore will allow the syncing of projects from Procore to QuickBooks. This Video shows how to do this.

The process is:

- Go to company wide admin tool in Procore

- Go to Project Settings on the right hand side and click -> Fieldset

- Edit fieldset (if there is no Fieldset click to create one and name it)

- Scroll to bottom, click add custom field

- Add new custom field with field name “Customer” and field type “Company”

- If you wish to have this on all projects in Procore, click ‘required’

- Click Save

How to use Smoothx to automatically create a new subcustomer in QuickBooks for the Procore project

Once this custom field is created, every time you create a project in Procore that needs to be synced to QuickBooks, you will need to have a QuickBooks customer selected in this field. To do this:

- Go to project level admin tool for the desired project

- Scroll down to the bottom, select the customer on the dropdown that has been synced across from QuickBooks -> Procore

- Click update

This will then create a new sub customer in QuickBooks online using the mapped parent customer you selected in the 'Customer' tab on the project.

In the case that the Procore company selected is mapped to a vendor in QuickBooks the project will not automatically sync. Make sure the selected company in Procore is linked to a 'Customer' in QuickBooks when looking at the Smoothx contacts mapping table

Mapping QuickBooks Projects that existed before Smoothx was brought in

If you are already using QuickBooks, you may have existing projects/subcustomers. These may also be active projects that are existing in Procore also. In this case we can link the Procore project to the already existing QuickBooks project.

In order to pull the existing QuickBooks projects you have already created, go into the mapping tab and under projects select QuickBooks projects and click sync:

From here, if you want to connect an existing QuickBooks project with an existing Procore Project, click on the chain link next to the QuickBooks project. A pop up will then appear where you can select the Procore Project you want to associate the Existing QuickBooks project with. Once this is done, it will move to the mapped tab, and the syncing will occur between the existing QuickBooks project you selected and the Procore project selected in the dropdown menu.

Mapping Procore Cost Codes with QuickBooks

Once Customer/vendor mapping and project mapping have been completed, the third primary mapping item is Procore cost codes.

There are a few different ways that Smoothx can map your Procore cost codes to QuickBooks Online.

OPTION 1: Map Procore Cost Codes to your Chart of Accounts (categories)

With this option Smoothx will map your Procore cost codes solely to your QuickBooks chart of accounts.

This will likely mean there is a many to one mapping, where you will have a detailed Procore cost code structure which is then grouped and push to a selection of accounts in your chart of accounts.

For exampe, below you will see several different Procore Cost codes being linked to one account in the chart of accounts 'Purchases'.

The benefit of this approach is it keeps QuickBooks simple, you will not have hundreds of codes in QuickBooks.

The implications of this approach is for the most part all cost information MUST start in Procore and Push to QuickBooks. As we are associating many Procore cost codes to one QuickBooks chart of account, if a cost starts in QuickBooks we will not no how to push it to Procore to the right, as there could be hundreds of codes allocated to the chart of the account.

For this approach you can map it two different ways:

1: Via the Smoothx interface

Under the mapping tab scroll to account codes. Click on QuickBooks Account and click sync. Then Click on Procore accounts and Click sync.

Then for each Procore cost code, select the chain icon. A pop-up will appear where you can then choose the QuickBooks chart of account you want the Procore cost code to sync too.

NOTE: once a Procore Cost Code is mapped it will move from the Procore tab and only exist in the mapped contact tab. In order for the Integration to function, there should be NO Procore cost cost in the Procore Account Tab once you have finished mapping

2: Via CSV import

The second approach to map Procore cost codes to QuickBooks chart of account is via a CSV import.

To do this firstly export your Procore cost codes directly from Procore. Reference this video on how to do that Video

Secondly export you QuickBooks Chart of accounts;

To export the your chart of accounts for QuickBooks Online as an excel spreadsheet, go to accounting -> chart of accounts:

Then, in the Chart of Accounts page click to run report:

Then, in the reports page, click to export to excel:

Now that you have both Procore cost codes and QuickBooks chart of account, in a spreadsheet create three columns. The column on the left input all your Procore cost codes. The middle column input Procore cost code name. The column on the right input the QuickBooks chart of account code/name that you want to allocate each Cost code to.

Send this excel spreadsheet to a Smoothx employee who can review and then import this for you

OPTION 2: Map Procore Cost Codes to QuickBooks Product and Services

QuickBooks offers a product and services section which you can allocate all QuickBooks costs and invoices too. The reason why this would be utilised is if you wanted to have a one to one mapping where you have the exact same Cost codes in both systems.

The benefit of this approach is two fold. 1. information can start in Procore or QuickBooks and pushed to the other system, thus a full integration is possible. 2. You are able to have granular reporting in both systems.

The reason why we connect to Product and services is because there is an unlimited amount. Whereas the QuickBooks chart of accounts is max of 300 (depending on subscription). As such all bills/expenses/invoices will be coded against the Product and Service, and then in QuickBooks you would map each produce and service to a chart of account for your general accounting purposes.

A Smoothx employee can instantly push all your Procore cost codes to QuickBooks products and services and map them, so this would be a simple implementation.

All that is required is to first load your Procore cost codes in the "Procore Item Codes" section , and secondly allocate a default account that will be applied to each Product and Service for the product/service's linked expense and income account.

Smoothx can only apply one account for income and one for expenses when pushing across the product/service. This can be adjusted afterwards on the QuickBooks side once Smoothx has pushed it through by going to the product / service list in QuickBooks and clicking 'edit' to adjust the income and expense accounts.

To allocate a default charge of account that will be associated to each Product/Service when pushing the cost codes from Procore to QuickBooks, click on the settings tab at the top.

Then on the left hand side select Defaults, and under QuickBooks Account codes section, populate the default chart of account you want applied to all product and services in the “bill code” row for the selected expense account for the service:

To select the income account for the service that will be pushed across, select the default 'invoice code'.

This will populate the fields shown here on the service once it pushes across to QuickBooks:

Finally for this option, ensure under defaults, and then default line item type, that 'Item' is selected.

This means that when syncing from Procore to QuickBooks, we will be using the items or product/services to send across the line items.

OPTION 3: Map Procore Cost Codes to QuickBooks Chart of Accounts and Product and Services

This option allows ultimate flexibility. If you are wanting QuickBooks to be as a simply as possible and will be performing job related reporting in Procore , but still require costs to be entered in Both Procore and QuickBooks , then mapping to both Chart of Accounts and Product and Services is the answer.

How this will function is information that starts in Procore and pushes to QuickBooks will push to your chart of account. Thus keeping detail in Procore, and high level grouping in QuickBooks.

Then for information that starts in QuickBooks, you will utilise Product and Services when entering the bill/expense etc, as this will ensure Smoothx knows which cost codes to push to in Procore.

To do this follow steps in Option 1 and 2 above.

Then under the settings tab, then on the left hand side under defaults, ensure the row titled “default line item type”, that CATEGORY is selected.

OPTION 4: Map Procore Cost Codes to QuickBooks Classes

QuickBooks classes is a column available in all bill/expenses in QuickBooks. The main reason why we have cost mapping to Classes is because QuickBooks has a function where you can live sync credit cards. This function is called “banking”, where a customer uses there credit card at a store, that transaction will then automatically appear in the Banking feed. From there customers categorise that transaction in the QuickBooks bank feed and the cost is created.

For whatever reason, QuickBooks product and services are not available in the banking feed, thus in order to push credit card expenses from the bank feed to Procore we have allowed customers to map cost codes to classes, which is available in the banking feed.

If you have a lot of credit card payments and use the banking feed heavily, then mapping cost codes to classes could be beneficial and save time.

The first step to utilise this function is to go to the settings tab and then click defaults. Then under “default class type” select “Cost Code”.

From here if you now click the mapping tab, you will see a new mapping table titled “cost codes”. This table will allow you to map your Procore cost codes into the class field in QuickBooks

Similar to the Chart of account or Product and service mapping, there will be three tabs. Tab 1 will show all mapped Procore cost codes with QuickBooks classes. Tab 2 will show all existing unmapped Procore cost codes. And tab 3 will show all existing unmapped QuickBooks Classes. In order to map Procore cost codes to QuickBooks classes, you can either 1. Request a Smoothx employee to push all Procore cost codes to the class field and automap for you. 2. You can load the cost codes you want in the QuickBooks class field, and then in the connector select auto map. Or 3. You can go to the Procore tab in the class mapping table and click the sideways arrow to push across a Procore cost code 1 by 1.

NOTE: the big con of this mapping is that you will not be able to map Procore cost types with QuickBooks (as we use class field to map cost types) thus you will only be able to use 1 cost type when pushing information from QuickBooks to Procore.

Mapping Tax Codes

If you are utilising Tax in QuickBooks, then you will need to map tax codes for the integration to function. If you are not using Tax in QuickBooks, then tax code mapping can be ignored.

To map tax codes you will need to create a tax code in Procore for each QuickBooks Tax code that you want mapped. If QuickBooks is broken out between sales and expense tax codes, you will need to make one in Procore for both sales and expense, for example a VAT 20% Sales and a VAT 20% Expense.

Reference this article on how to create tax codes in Procore.

Once this is complete, within Smoothx mapping, scroll down to Tax and then click on Procore Tax codes and click sync. Now click on QuickBooks tax codes and click sync.

Next to each QuickBooks Tax code select the chain link icon, a popup will appear where you can choose the Procore tax code you would like to allocate to the QuickBooks tax code. NOTE: once the tax code is mapped it will move from the QuickBooks tax code tab and into the mapped tax code tab.

Finally, under the settings tab, if you click on defaults on the left hand side, under the default tax code row select a QuickBooks tax code that should be applied if none is selected in Procore.

Employee timesheet and labour cost Mapping

Smoothx has developed two functionalities regarding Employee Timesheet.

Functionality 1: Timesheet push to QuickBooks time activity

If you are using QuickBooks time activity for payroll, Smoothx can push a Procore timesheet into QuickBooks time activity. We will sync across employee name, hours, days, and time type

Functionality 2: Labour cost creation in Procore

Smoothx has developed a labour costing module. This will allow you to input an hourly rate for each employee, for each day, for each time type. When a timesheet/daily log timecard entry is approved, the hours inputted in Procore will be multiplied by the rates imputed in Smoothx for the employee and a Procore payroll direct cost will instantly be created. This will ensure you will get real time labour costing in Procore. This will not affect QuickBooks at all, as such can be utilised whether you are using QuickBooks time activity or not.

This Video will go through Employee labour cost and timesheet mapping and setup.

Optional Mapping

If you are using Locations or Classes in QuickBooks, chat to your Smoothx Onboarding manager who will assist in mapping those fields between Procore and QuickBooks for you.

Required Settings before going Live:

Smoothx Provides a settings tab to configure the QuickBooks integration to be purpose fit for your business.

There will be optional settings for each part of the integration, that can be turned on or off. For a detailed explanation of each of the setting configurations, reference this DOC

Prior to going live with the integration, there are a couple of settings that must be configured. We will go through the required settings now.

Required Settings before go live:

Under the settings tab, click on “Defaults” on the far left hand side.

Default Line Item Row Setting:

- If you have mapped your Procore cost codes to your QuickBooks chart of accounts (reference Cost code mapping above), then ensure category is selected here.

- If you are mapping solely to your QuickBooks product and service (there is no chart of account mapping in Smoothx), then ensure item is selected here

Default tax code:

- If you are using tax in QuickBooks, ensure a default tax code is selected

- If you are not using tax in QuickBooks, ensure this row is empty.

QB Invoice Account Code:

- Input an account receivable/income code here. This is the code where your sales invoice in QuickBooks will be coded to if there is a problem with the mapping

QB Bill Account Code:

- Input a accounts payable/expense code here. This is the code where your bills in QuickBooks will be coded to if there is a problem with the mapping

QB Retention Payable Retained Code:

- The code selected here will be what is applied in QuickBooks to all retention held in Procore Commitment Payment application. This must be selected if using retention on Subcontractors/Vendors in Procore, and if not the sync will fail.

QB Retention Payable Released Code

- The code selected here will be what is applied in QuickBooks to all retention released in Procore Commitment Payment application. This must be selected if using retention on Subcontractors/ Vendors in Procore, and if not the sync will fail.

QB Retention Receivable Retained Code

- The code selected here will be what is applied to all retention held in Procore Prime Contract Payment application. This must be selected if retention is getting held against yourself/on your sales invoice in Procore, and if not the sync will fail.

QB Retention Receivable Released Code

- The code selected here will be what is applied to all retention released in Procore Prime Contract Payment application. This must be selected if retention is getting held against yourself/on your sales invoice in Procore, and if not the sync will fail.

Procore Bill Code

- The code selected here will be what is applied to all Direct Cost created in Procore from a QuickBooks Bill if there is a mapping failure. Thus if the code selected in QuickBooks bill is not mapped in Smoothx mapping section, instead of the sync failing, Smoothx will automatically apply the selected code instead in the Procore Direct Cost

Procore Payroll Code

- The code selected here will be what is applied to all Direct Cost created in Procore from a QuickBooks Payrun/timesheets if there is a mapping failure. If there is no code selected in the QuickBooks Payrun/timesheet or if the code selected is not mapped in Smoothx mapping section, instead of the sync failing, Smoothx will automatically apply the selected code instead in the Procore Direct Cost

Under the Direct Cost setting

Sync Expense Direct Costs

- If you want to be able to enter direct cost in Procore and for Smoothx to sync that over to a QuickBooks bill, then toggle this setting on

Default Cost Type

- This row must be selected with a Procore cost type. If you are not using the optional classes mapping, then a QuickBooks bill will not push to Procore Direct costs unless there is a cost type selected here. NOTE: what is selected here is the cost type that will be applied to all direct cost syncing from QuickBooks.

The above are the settings required for the integration to be turned on Live. If you would like to go through all the settings before turning the integration on live, ask your Smoothx Onboarding manager to go through each setting with you.

YOU ARE NOW READY TO TURN THE Smoothx Procore <> QuickBooks INTEGRATION ON LIVE.